Uae Corporate Income Tax 2024. While the new legislation is expected to bring a wave of changes to how businesses operate financially, market leaders and analysts have forecast the uae’s. Since the average world corporate tax is around 23 %, at 9% the uae corporate tax is still significantly low.

After the conclusion of the first taxable period, companies must submit their corporate tax returns to the federal tax authority (fta). Explore the intricacies of corporate tax in the uae with our comprehensive 2024 guide.

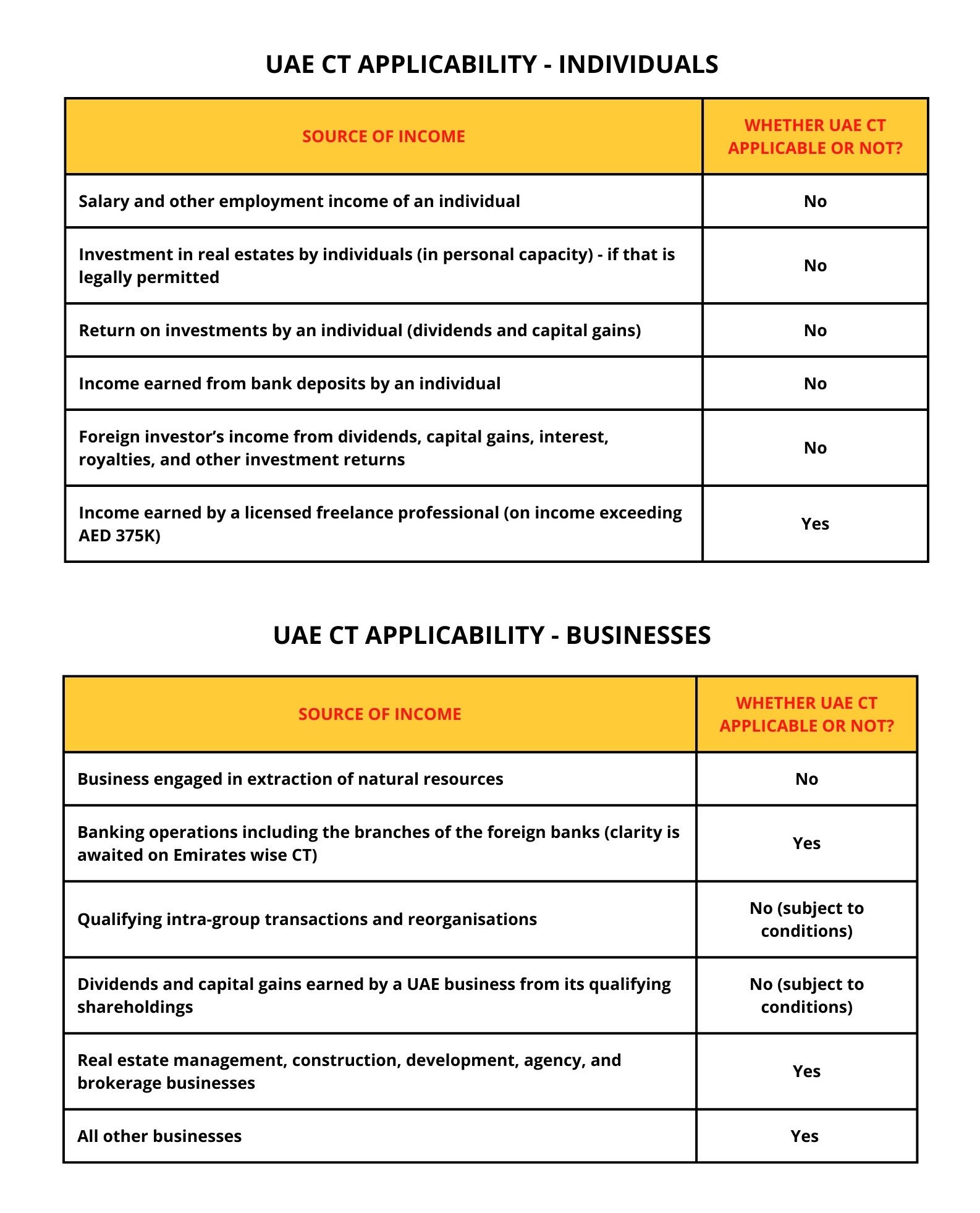

Who Needs To Register For Corporate Tax In Uae?.

Uae corporate tax is 9%;

The Uae Has Introduced A Corporate Income Tax, Signalling A Significant Shift In Its Tax Regime.

After the conclusion of the first taxable period, companies must submit their corporate tax returns to the federal tax authority (fta).

The Corporate Tax Law Provides The Legislative Basis For The Introduction And Implementation Of A Federal Corporate Tax (“ Corporate Tax ”) In The Uae And Is Effective For Financial Years Starting On Or After 1 June 2023.

Images References :

Source: www.shuraa.in

Source: www.shuraa.in

UAE Corporate Tax 2024 A Complete Guide, The uae has introduced a corporate income tax, signalling a significant shift in its tax regime. The law and details of the.

Source: www.facts.ae

Source: www.facts.ae

Corporate Tax in UAE Understanding the new regulations, The law and details of the. Profits below aed 375,000 are exempt from corporate tax;

Source: metropolitan.realestate

Source: metropolitan.realestate

The UAE Ministry of Finance announces the introduction of corporate tax, Who needs to register for corporate tax in uae?. The law and details of the.

Source: www.saifaudit.com

Source: www.saifaudit.com

UAE CORPORATE TAX Saif Chartered Accountants UAE, Discover the united arab emirates tax tables for 2024, including tax rates and income thresholds. After the conclusion of the first taxable period, companies must submit their corporate tax returns to the federal tax authority (fta).

Source: www.bmsauditing.com

Source: www.bmsauditing.com

UAE Corporate Tax for Free Zone Person Qualifying, Explore the intricacies of corporate tax in the uae with our comprehensive 2024 guide. In this sense, this new regulation will be effective for the fiscal years that begin on june 1, 2023.

Source: www.bmsauditing.com

Source: www.bmsauditing.com

Ways to Implement Corporate Tax in UAE from June, 2023, This submission is mandatory, even if a. Since the average world corporate tax is around 23 %, at 9% the uae corporate tax is still significantly low.

Source: www.spectrumaccounts.com

Source: www.spectrumaccounts.com

Basic Guide To Corporate Tax In The UAE Spectrum Accounts, Profits below aed 375,000 are exempt from corporate tax; Stay informed about tax regulations and calculations in united arab.

Source: sortingtax.com

Source: sortingtax.com

An Complete Guide on Dubai Tax (Dubai Corporate Tax) Sorting Tax, Profits below aed 375,000 are exempt from corporate tax; Discover the united arab emirates tax tables for 2024, including tax rates and income thresholds.

Source: en.protothema.gr

Source: en.protothema.gr

Global Corporation Tax Levels In Perspective (infographic, As the uae gears up for the implementation of corporate tax in 2024, businesses are required to ensure compliance. This submission is mandatory, even if a.

Source: www.efficientcfo.com

Source: www.efficientcfo.com

How Businesses are Gearing up for New Corporate Tax in UAE?, Companies must register for corporate tax in 2024; Gain insights into regulations, exemptions, and the impact on businesses.

Uae Corporate Tax Is 9%;

Calculate your income tax, and how much your business will pay once new corporate tax regime comes into effect!

Profits Below Aed 375,000 Are Exempt From Corporate Tax;

The law and details of the.